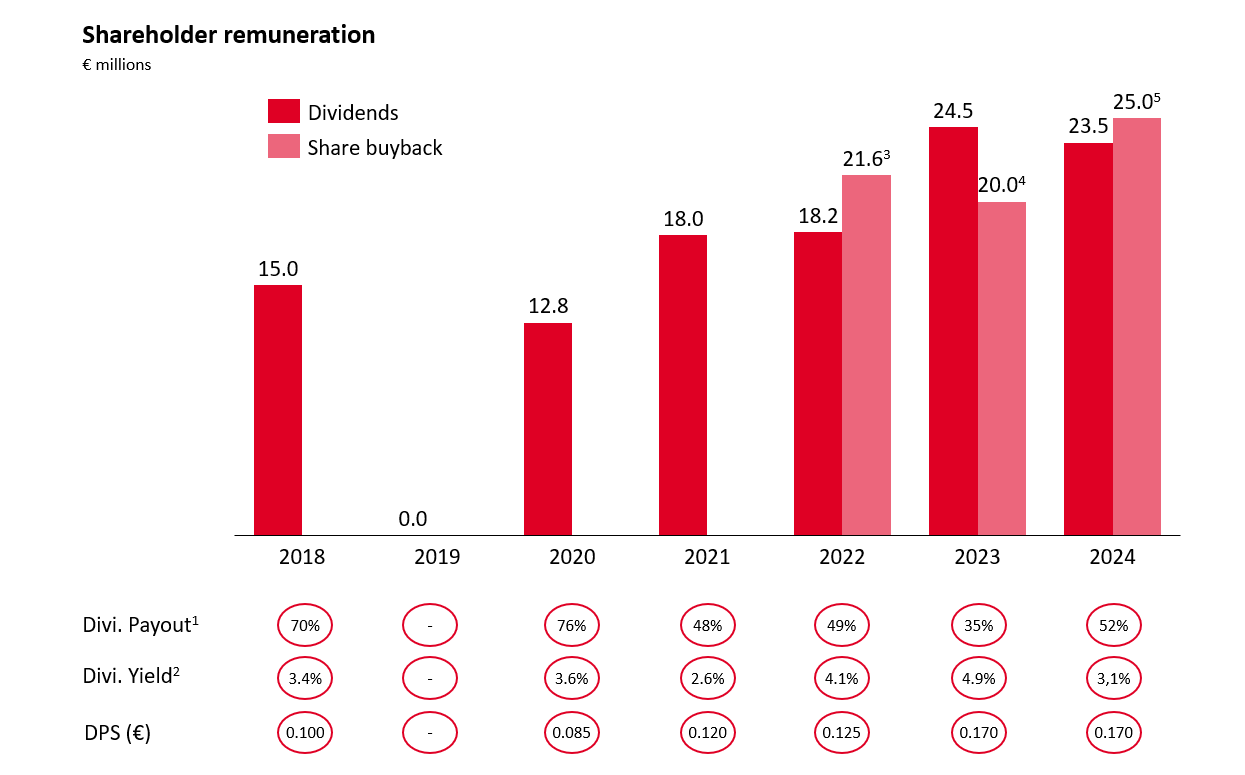

Key principles

i. Enables financial capacity to maintain strategic flexibility to meet the goals of investment in business growth and to continue to position CTT as a reference in logistics and e-commerce in Portugal and Spain;

ii. Implement a remuneration policy that is attractive, constituting an adequate source of income for its shareholders;

iii. Includes an ordinary dividend component, which is intended to have a greater recurrence, and a share repurchase component, which will be more casuistic and applicable according to market conditions.

1 Based on individual accounts; 2 Yield calculated taking as a reference the year end share price of each year;

3 Executed in 2022, 6.085m shares acquired and cancelled; 4 Executed in 2023/24, 5.475m shares acquired and cancelled; 5 Executed in 2024/25, 4.620m shares acquired and cancelled.

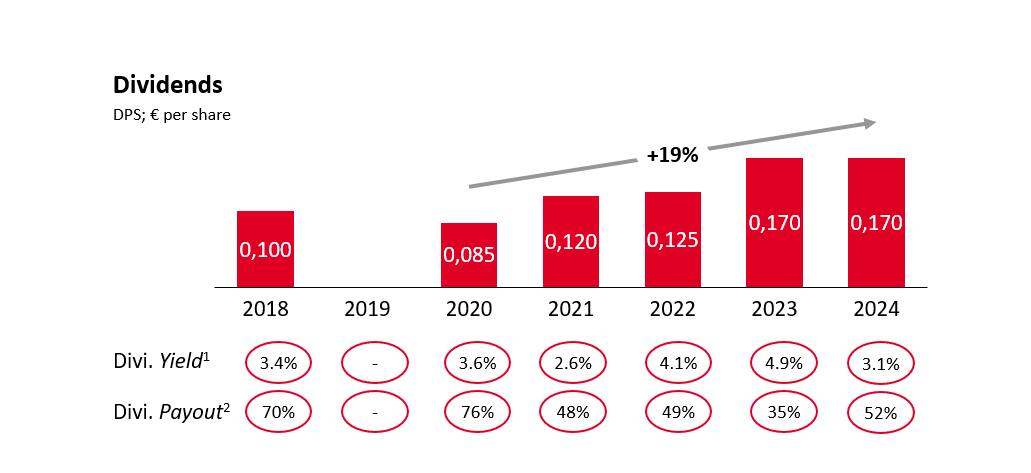

Shareholder remuneration principles – dividends

Targeting to pay out between 35% to 50% of net profit in recurrent dividends.

1 Yield calculated taking as a reference the year-end share price of each year; 2 Based on individual accounts;

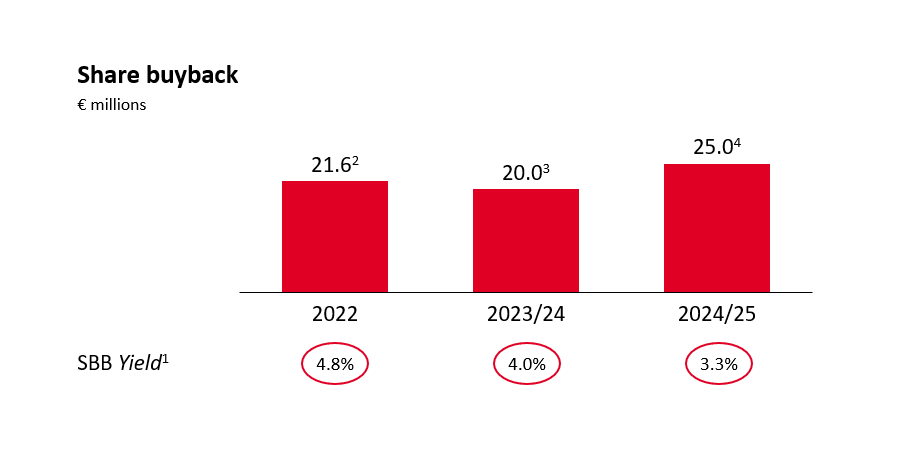

Shareholder remuneration principles – Share buyback

Share repurchase component, which will be more casuistic and applicable according to market conditions.

Subsequent cancellation of the shares purchased, in the presence of adequate market conditions.

1 Yield calculated taking as a reference the market cap at year end of 2022, 2023 and at end of 2024 respectively; 2 Executed in 2022, 6.085m shares acquired and cancelled; 3 Executed in 2023/24, 5.475m shares acquired and cancelled; 4 Executed in 2024/25, 4.620m shares acquired and cancelled.

Consult here the press releases related to the share buyback program.